Alpha Rank's Best Stock Picks - Get Up to 2x Returns with Alpha Portfolio

AlphaRank’s best portfolios are just a few clicks away. Join now to start building your wealth.

What is Alpha Portfolio?

Under the guidance of AlphaRank’s quantitative analysis team, Alpha Portfolio is a stock recommendation tool designed to help you create a portfolio that outperforms the market. Our specialists perform data-based quantitative research and analysis to identify stocks with long-term growth potential.

We offer a carefully selected and regularly updated list of over 500 top-quality companies from 64 global exchanges. Structured into two portfolios—Alpha US and Alpha World—both are broadly diversified across industries and aligned with the modern Five-Factor Portfolio Model.

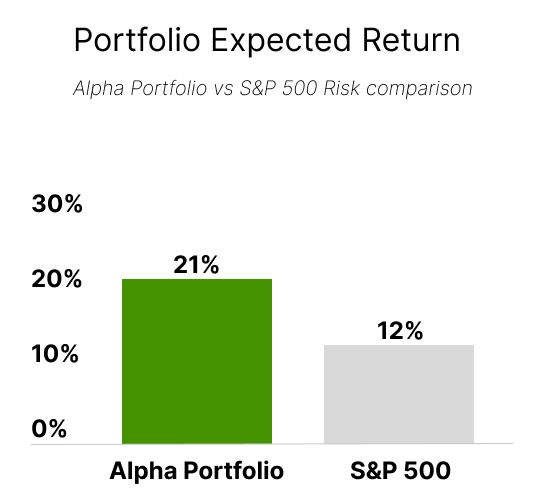

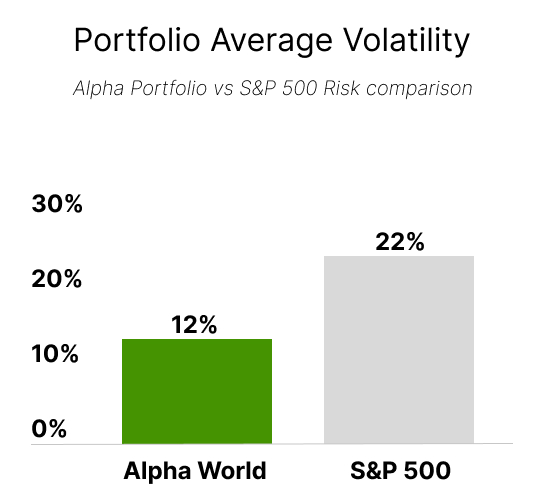

Our goal is to create a portfolio that not only outperforms the market but also carries a lower level of risk, resulting in a higher Sharpe ratio and making your assets less volatile and significantly more stable.

We regularly update our portfolios to ensure you are always informed and able to respond promptly to changing market conditions.

How Can You Prove Your Results?

We are confident in the quality of our product and update performance statistics in real-time at the end of each trading day. We also measure the Sharpe ratio, Expected annual return, and current Risk Level, all of which are also updated in real-time at the end of each day. We do not rely on backtesting or draw conclusions based on the past performance of individual stocks.

We evaluate the quality of the portfolio as a whole, taking into account the current weightings of each stock in the portfolio. You can view the corresponding weightings in the companies table.

How Do You Achieve a Lower Level of Risk in Your Portfolios?

In constructing our portfolios, we use the Risk Parity method—a portfolio strategy focused on distributing risk evenly across assets rather than maximizing expected returns. Unlike traditional strategies that often emphasize high-return or high-volatility assets, Risk Parity aims to create a more stable portfolio with balanced risks.

Our focus is on managing volatility to achieve higher diversification. Risk Parity doesn’t involve forecasting returns; instead, it relies on historical measures of asset volatility and correlation. The primary goal is to reduce risk concentration and smooth out portfolio fluctuations, which is especially beneficial during periods of market instability.

Risk Parity helps create a portfolio that remains stable even in turbulent market conditions. This even distribution of risk provides resilience during crises, making it particularly valuable for long-term investors.

What Exactly Will I Receive?

-

Access to more than 500 high-quality companies from 64 exchanges all over the world

-

Portfolio Builder tool that allows you to build your own portfolios in a couple of clicks based on Alpha World and Alpha US

-

Automated tool to weight your portfolio using the following strategies: Risk Parity, Expected Returns Parity, and Equal-Weight.

-

Real-Time Portfolio Updates and Calls to Action

-

Access to Alpha US portfolio composition, structure and weights

-

Access to Alpha World portfolio composition, structure and weights

-

7-Day Money-Back Guarantee

Frequently Asked Questions

The Quantitative Analysis team manually selects candidate companies based on fundamental and statistical data, such as profitability, efficiency, growth, financial strength, hedge fund trust, expected returns, risk, and Sharpe ratio. We analyze company data from the past five years only, as older data does not reflect the current state of the company, industry, or the economy as a whole.

Based on the collected data, we make a decision on whether to include or exclude a candidate company from the portfolio.

First of all, we are confident in our product and its quality, which is why we provide real-time portfolio statistics so that everyone can verify it at any time. None of our competitors do this.

We work with 64 exchanges worldwide and support 100,000 stocks and ETFs, while other services typically cover only one exchange or region.

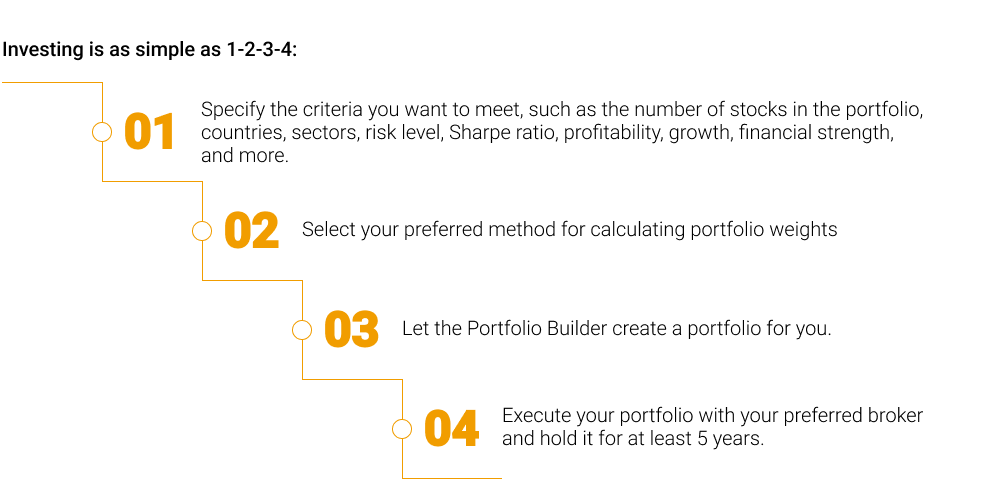

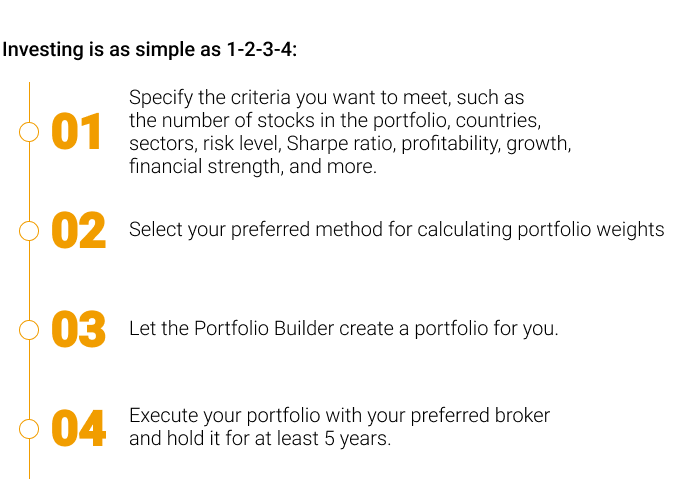

- Go to the Portfolio Builder section.

- The portfolio should consist of at least 50+ companies, but the more, the better. Remember Harry Markowitz’s words: “Diversification is the only one free lunch,” so don’t neglect it.

- Specify the target number of stocks in the portfolio in the appropriate field of Portfolio Builder.

- Select the countries and sectors you are interested in. We recommend maximizing diversification to minimize the portfolio’s sensitivity to regional economies.

- Set selection criteria such as Alpha Rank, Profitability, Efficiency, Growth, Financial Strength, Hedge Fund Trust, and the weight of sectors and countries.

- Click the “Create Portfolio” button.

- Portfolio Builder will create a portfolio for you based on the top 500 companies, considering the set criteria.

- Choose the desired method for calculating the weights of companies in the portfolio. We recommend using the Risk Parity method, as it provides the best diversification and reduces overall portfolio volatility.

- Buy the created portfolio through your broker.

- Hold the portfolio for at least 5 years.

First and foremost, the product is designed for long-term investors who are ready to invest for 5 years or more. The portfolio does not require active management or frequent opening and closing of positions. We review the composition and weightings of the portfolio approximately once per quarter.

Our portfolios are highly diversified across sectors and exchanges, giving you flexibility in building your own portfolios.

No, you do not. Alpha Portfolio is a passive investment product, so we do not require monthly payments. The portfolio is typically reviewed once per quarter as new financial reports are released. By purchasing Alpha Portfolio, you receive one-year access without automatic renewal. If desired, you can purchase a Lifetime license.

The price for an annual license is $150, and the price for a Lifetime license is $400.

- Click on the ‘Launch Application’ button, and you will be directed to the Alpha Rank application.

- Create a free account; it will take just 1 minute, or use your existing Google account.

- After registration, you will be able to use the entire application without any limitations, but Alpha Portfolio will not be available yet.

- Navigate to your personal account in the top right corner and purchase a license by clicking the “Become a Premium Member” button.

Yes, you can. If, for any reason, you are not satisfied with the service, you may request a refund within 7 days of your initial purchase. Please read our Terms of Use for more details: https://alpharank.app/terms-of-use/